Arizona Tax Credit

Did you know that you can donate to Neeley's Chronic Joy Foundation without taking extra money out of your pocket?

Watch our short 2 minute video below to learn more about this opportunity to change lives!

What is a QCO (Qualified Charitable Organization)?

Neeley’s Chronic Joy Foundation is a QCO, because 50% of what we spend goes to providing basic needs to chronically ill children in Arizona.

What is the Arizona tax credit?

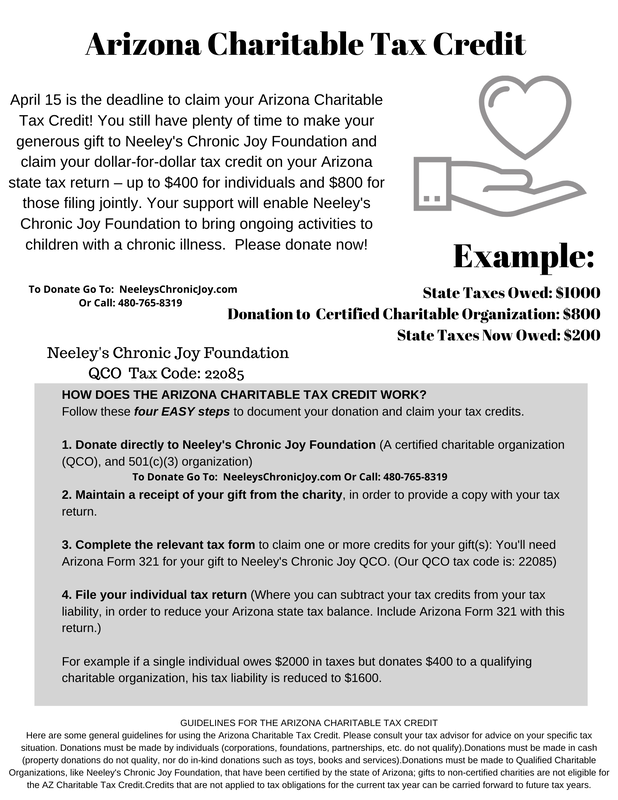

The Arizona tax credit is a way for you to contribute to us, a QCO, without taking extra money out of your pocket. Think of it like this, instead of paying $800 (or $400 if filing individually) to the state, the state will allow you to pay that owed money to Neeley’s Chronic Joy Foundation. That means you can pay less to taxes, and more to a great cause!

How does it work?

1. At any point before April 15, you can donate directly to Neeley's Chronic Joy Foundation. ($800 filing jointly, or $400 individually)

2. We will send you a receipt. File Arizona Tax Form 321 using our QCO code that will be shown on your receipt.

3. Receive a dollar-for-dollar credit on your state taxes, and find joy in knowing you changed lives!

I already donated to a school. Can I still donate?

Assuming you still owe more taxes, you can take full advantage of both the QCO and school credit at the same time!

I have someone else do my taxes for me.

Great! Just give them your receipt and they will know exactly what to do.

I do my own taxes on TurboTax, etc.

It’s in there!

Already paid state taxes throughout the year via your employer?

No worries! You can still donate to Neeley’s Chronic Joy Foundation and receive a dollar-for-dollar tax credit refund.

Why?

It’s money you already have to spend, you are just choosing where you want it to go. Your donation and a few minutes of your time will provide an entire experience for a Joy child that needs it most. It’s easy for you, but life changing for a child!

Arizona Tax Credit Form

Download File